In July 2018, Broadcom announced its plan to acquire CA Technologies for almost $19 billion. While analysts have furiously debated the merits of a chip manufacturer buying an enterprise software company, the CA acquisition heralds a momentous shift in the $25 billion IT operations management (ITOM) software market.

For more than two decades, four technology vendors – BMC, CA, IBM and HP – have dominated the ITOM software market. In 2012, these big four collectively accounted for 55% of the ITOM software industry. By 2017, their market share had declined to less than 30% (Gartner).

More crucially, the CA acquisition means that the big four as you’ve known them no longer exist. Here is how the big four lost their way – and why IT leaders need to start working with a new breed of insurgents that are transforming IT operations management.

A Quick History Lesson: How Four Incumbents Lost Their Way

A decade ago, most ITOM startups expected to scale and then sell out to a big four provider at some point in their journey. Today, most startups begin with a business plan that’s all about stealing market share from a big four product suite. Here’s a synopsis of where these four companies stand today.

- BMC: BMC Software started life as a mainframe management tools company in 1980. By 2013, it was clear that the company had run out of steam. BMC’s annual revenues from 2010-2013 showed a tepid CAGR growth of 0.78% - $1.91bn in 2010 versus $1.97bn in 2013. In May 2013, private equity players Bain Capital and Golden Gate Capital acquired a majority stake in BMC for $6.9bn. Five years later, another private equity firm, KKR, agreed to buy BMC from its previous investors for $8.5bn. In 2018, BMC’s annual revenues were still stuck at $2bn, despite significant product and go-to-market investments over the last five years.

- CA Technologies: CA was the dominant mainframe utility software company of the 1980s. A serial acquirer, CA was well known for buying companies and milking customers for maintenance fees. In recent years, CA experienced the same problems of stagnant products and stalled growth. The company registered a negative CAGR of 0.18%, with revenues marginally declining from $4.26bn in 2015 to $4.23bn in 2018. With all options exhausted, CA sold itself to Broadcom last month.

Figure 1 - Four companies have shaped the IT operations management landscape for decades.

It’s finally time to say goodbye to these Big Four ITOM vendors. - IBM: IBM Tivoli started in 1989 as a systems management vendor for IBM mainframe hardware. In 1996, IBM bought out Tivoli and folded over thirty acquisitions into the Tivoli division. By 2012, IBM Tivoli was the leading ITOM software player with $3.2bn in annual revenues. However, IBM made few actual investments in upgrading the Tivoli architecture to meet the demands of a new generation of ITOM buyers. In 2016, IBM signed a 15-year deal with HCL Technologies for offloading the development and maintenance of Tivoli products. Today, the best mention you get to the venerable Tivoli brand on IBM’s website is deep in its Cloud & Smarter Infrastructure division.

- HP: HP launched its OpenView family of IT management tools in the early 1990s. After acquiring Peregrine, Mercury Interactive, and Opsware in the last decade, HP grew its OpenView portfolio to more than $1bn in annual revenues. However, with all the troubles that HP experienced after the Autonomy deal, it sold its entire ITOM software portfolio to Micro Focus in 2016. Reacting to the HPE-Micro Focus $8.8bn merger, The Register pointed out that “Micro Focus is considered by some to be something of a retirement home for software businesses that have seen better days.”

The Big Four Are (Mostly) Dead - Here’s Why.

So why did the big four players lose their way? A distinct absence of innovation, a strong dependence on legacy portfolios and maintenance revenues, and unwieldy product suites sealed the fate of the big four. Here are our top three reasons for their decline:

Reason #1 - Acquisitions Are Not A Substitute For Organic Innovation

A big reason for the fall of the legacy ITOM software providers was an over-reliance on acquisitions. The big four executives spent all their time pursuing deals and acquiring the hottest technology startups – instead of keeping their product stacks modern and relevant. The playbook was simple: fold the latest acquisition into an existing division and incentivise armies of salespeople to bundle and sell the new solution. Here’s a quick timeline of some notable acquisitions made by the big four since 2000:

- BMC Software has splurged on companies like Remedy (IT service management), ProactiveNet (performance management), RealOps (runbook automation), BladeLogic (data centre automation), Cordiant (application performance monitoring), and Numara (IT service management) to bolster its ITOM software portfolio

- CA Technologies built its monitoring portfolio with acquisitions like Wily Technology, Nimsoft, WatchMouse, and RunScope while Arcot, Xceedium and IdMLogic helped shape its identity management solutions

- IBM Tivoli acquired CIMS Lab (IT asset utilisation), Micromuse (event correlation), Collation (discovery), BigFix (patch management), and Intelliden (network automation) to keep its Tivoli division growing every year

- HP bought companies like Peregrine Systems (IT service management), Trustgenix (identity management), Mercury Interactive (IT service delivery), Bristol Technology (business transaction monitoring), Opsware (data centre monitoring), and ArcSight (security) to extend the capabilities of its OpenView suite

Figure 2 - Despite 40+ acquisitions in 15 years, CA Technologies was never able to reduce its dependence on mainframe revenues.

Reason #2 - How Legacy Software And Maintenance Fees Propped Up Big Four Revenues

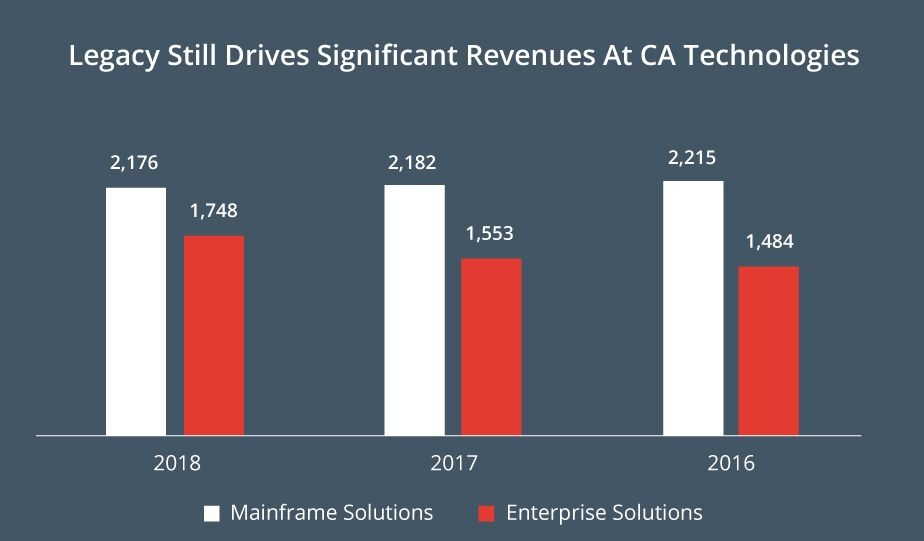

If there’s one technology that embodies legacy, it is mainframes. The dirty secret of the big four was their addiction to mainframe monitoring and management for revenue generation. If you look at CA’s revenues (excluding services) in 2018, mainframe solutions accounted for 55% of revenues and 64% of segment operating margins. In contrast, enterprise solutions drove only 45% of revenues and just 9% of its segment operating margins. Similarly, for BMC, mainframe tools brought in 43% of overall revenues in 2013 – the last year in which the company reported financial results before selling itself.

Another factor that prevented the big four from embracing innovation, in the form of SaaS delivery models, is maintenance fees. At BMC, maintenance revenues accounted for 52% ($1.12bn), 50% ($1.08bn), and 50% ($1.02bn) of overall revenues in 2013, 2012 and 2011. Micro Focus made 67% ($720.7m) and 66% ($754.5m) of its revenues from maintenance fees in 2017 and 2016.

Figure 3 - Legacy portfolios like mainframe solutions still make up most of CA’s revenues.

Reason #3 - Big Four Suites: Bloated, Disjointed, and Out of Touch With Market Realities

When you analyse any big four solution, you find suites like HP OpenView are built on legacy tools like Operations Manager i and Network Node Manager i. Even BMC’s recent Cognitive Service Management sits on age-old solutions like Remedy and Discovery. The big four resorted to buying and folding different products into their ITOM portfolios to keep flagship suites like Tivoli and TrueSight relevant. Sales teams then sold the mantra of a single pane of glass for enhanced visibility and control across your IT infrastructure.

Most big four suites would take several quarters to implement, along with the need for expensive third-party professional services. Besides the time and cost overruns, the process of consolidating disparate products into a single framework was a Herculean challenge. Most big four suite implementations failed to deliver the efficiency, simplicity, and scalability that was originally promised during the sale.

Don’t Fear Change, Embrace It

What’s next for DevOps and IT operations teams? New players have emerged to fill the vacuum created by the exit of the big four. Cutting-edge, cloud-based technologies are taking the place of tool suites. And business consolidation, including the likes of Splunk/VictorOps, VMware/CloudHealth, are presenting new challengers to old technology. The future is agile, modular and flexible. As business blazes a new trail forward, it’s time for technology to transform along with it.

This article was first published on Cloud Tech News.

Next Steps:

- Learn how to unify operational silos and eliminate firefighting with service-centric AIOps.

- Attend our OpsRamp + ITSM webinar for more on our incident management capabilities.

- Contact us to meet with one of our solution consultants.

![[Report] Top Trends In AIOps Adoption](https://blog.opsramp.com/hs-fs/hubfs/Blog_images/AIOps%20Adoption%20Report%20/CTA-AIOps-Adoption.jpg?width=1180&name=CTA-AIOps-Adoption.jpg)